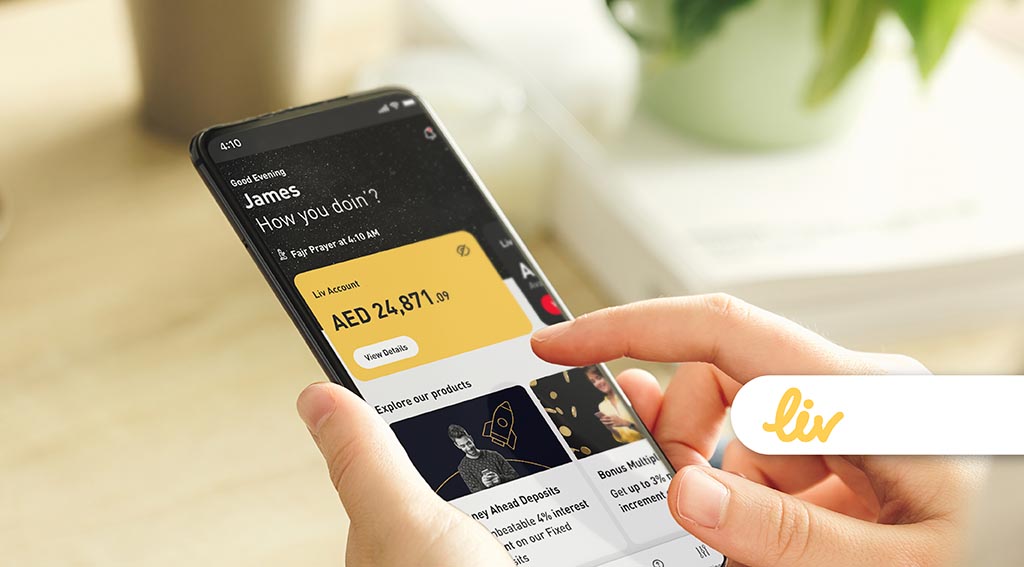

Digital bank Liv, launched by Emirates NBD in the UAE, has recently introduced a new digital lending proposition. This offering, available until the end of 2023, allows eligible Liv customers to access instant personal loans without any fees through the Liv app. The personal loans come with an interest rate of 8.99% per annum and flexible repayment terms of 12 to 48 months.

To qualify for this offer, customers must not have an existing Personal Loan on Liv and are required to transfer a salary of more than AED 5,000 to their Liv account for at least three months. During the promotional period, any fees charged will be refunded to customers within the same month.

Marwan Hadi, Group Head, Retail Banking and Wealth Management at Emirates NBD, emphasized Liv’s commitment to introducing innovative products to its platform, further establishing its position as a leader in digital banking in the UAE. He stated, “Through innovative products and fully digital offerings like these, we aim to support our customers’ financial goals and aspirations, while delivering exceptional digital experiences.”

Liv has been a pioneer in the digital banking space, introducing products such as the Bonus Multiplier Account and the Money Ahead Deposit. Additionally, it offers a unique credit card that enables customers to switch rewards between Skywards miles and cashback with a single click. The digital bank’s Goal Accounts service allows customers to effortlessly save money for their financial goals while earning attractive returns on their balances.

Furthermore, Liv’s family app for young individuals, Liv Young, designed for individuals aged between 8-17 years, continues to generate interest in the market.

This move demonstrates Liv’s ongoing commitment to providing innovative financial solutions and a seamless digital banking experience for its customers.

Get the latest Fintech Middle East News delivered to your inbox once a month.

I have over 10 years of experience in the field of cryptocurrency and blockchain technology. I have attended numerous conferences and events around the world, and my work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and Yahoo Finance.